Invest With Diligence

401K style investing is what we are NOT. The cookie cutter approach to allocating your money and subsequently revisiting once a year is not responsible money management in our opinion. Rather we continuously balance and monitor your money so as to not miss market opportunities and tax optimization windows.

Our Approach to Investing is Methodical Yet Nimble

While our management style is fiercely independent, four factors mechanically guide our decision making.

The relationship between us will be long. As such, behind the scenes we are monitoring and reallocating your investments as cash flow patterns become evident, contributing to our learning.

The name of the game is to invest wisely and to take advantage of as many value adding activities as we can find. This is only possible after close examination of your complete financial picture and institution of an efficient strategy selected from millions of possible strategies.

Wealth managers typically are primarily focused on achieving superior returns with less concern with anything else. Sometimes however their decisions will lead them to make trading errors that can trigger taxable events, often negating the gains they work so hard to create. We balance tax burden with capital gains to find the most efficient way possible to retain earnings and curb losses.

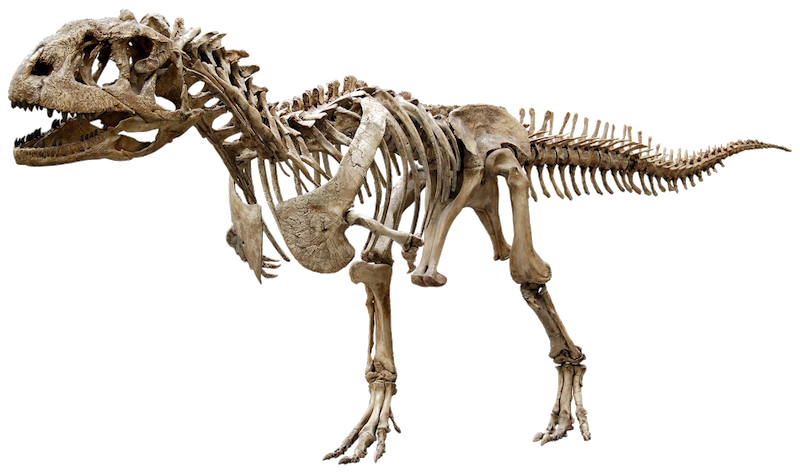

Stock markets are volatile. Once great companies, through scandal, hardship, or poor management can lose value quickly, reducing the value of the stocks held by their investors. Therefore it is important to identify these companies and reduce or eliminate the positions in the stocks we manage of theirs rather than continue to hold these stocks and “let it ride”, hoping they don’t continue to deteriorate.

Our Advisors

Our team is focused on creating and maintaining investment portfolios that highly correlate with your cash needs through time. We do this through a disciplined and continuous process of Money Allocation, Trading Dynamicism, Tax Harvesting, and Sector Weighting.

John Kamm, MBA

Founder at Alphalinked Investments

Michael Martin, CRPC®

Finacial Advisor

Ruby Duan, CPA

Chief Investment Officer